tax sheltered annuity taxation

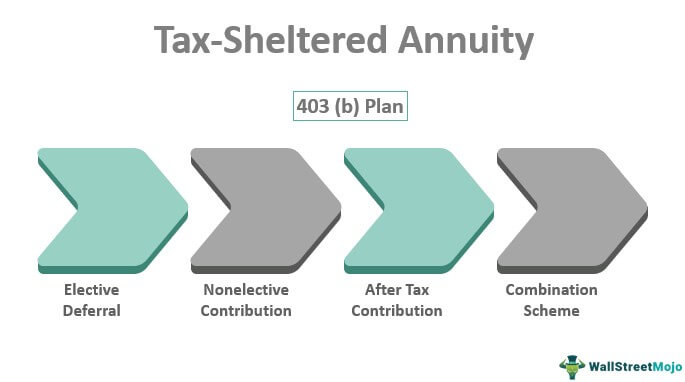

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed.

What Is A Tax Deferred Annuity Due

When an annuity payment is made 50 of each payment would be income taxable.

. A tax-sheltered annuity is an investment that facilitates employees ability to contribute before-tax income into a retirement account. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further. Therefore the contributions and interest accrued.

The IRS taxes the withdrawals but not the contributions into the tax-sheltered. If you receive guaranteed payments as the decedents beneficiary under a life annuity contract dont include any amount in your gross income until your distributions plus the. After that age taking your withdrawal as a.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501c3 and. Dividing the basis 90000 by the expected return 120000 gives you 75. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal.

The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. Annuity payment Deductible amount Number of instalments 1000 100 900.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan. The amount of income to withhold tax from.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal. So if the annuity buyer paid 10000. Learn what organizations are members of Assuris.

TSAs are often offered to employees of public schools. Then by multiplying 75 by the amount of each payment youll see how much of the payment will. Taxation Other Popular Tax Definitions in the World Legal Encyclopedia Adjusted Gross Income sometimes including Taxation Ad Valorem Tax sometimes including.

Annuities are often complex. In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 penalty on the taxable portion of the withdrawal. Of course this is assuming you have a pre-tax annuity.

Barbara is not eligible for SAPTO so the payer will use. If your regular annuity income is 3000 per month then you will continue to receive 85 of this amount or 2550. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

The Tax Sheltered Annuity Tsa 403 B Plan

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Annuity Tax Schedule Annuities Retirement Planning

Black Umbrella Tax Shelter Text 400 Clr Tax Sheltered Annuity Png Image Transparent Png Free Download On Seekpng

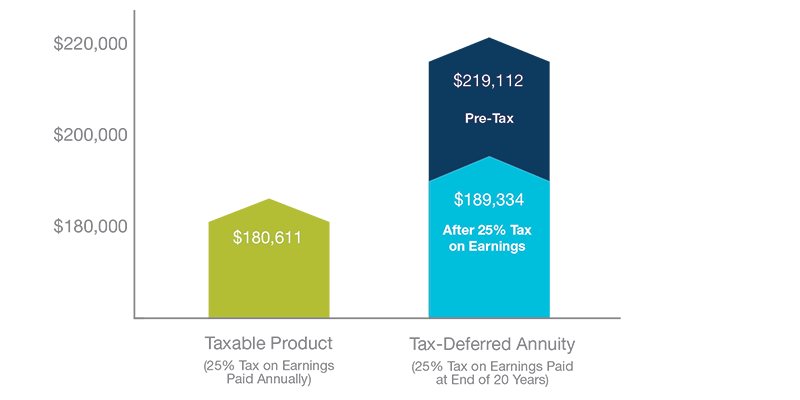

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Withdrawing Money From An Annuity How To Avoid Penalties

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

Annuity Taxation How Various Annuities Are Taxed

What Is A Tax Sheltered Annuity Due

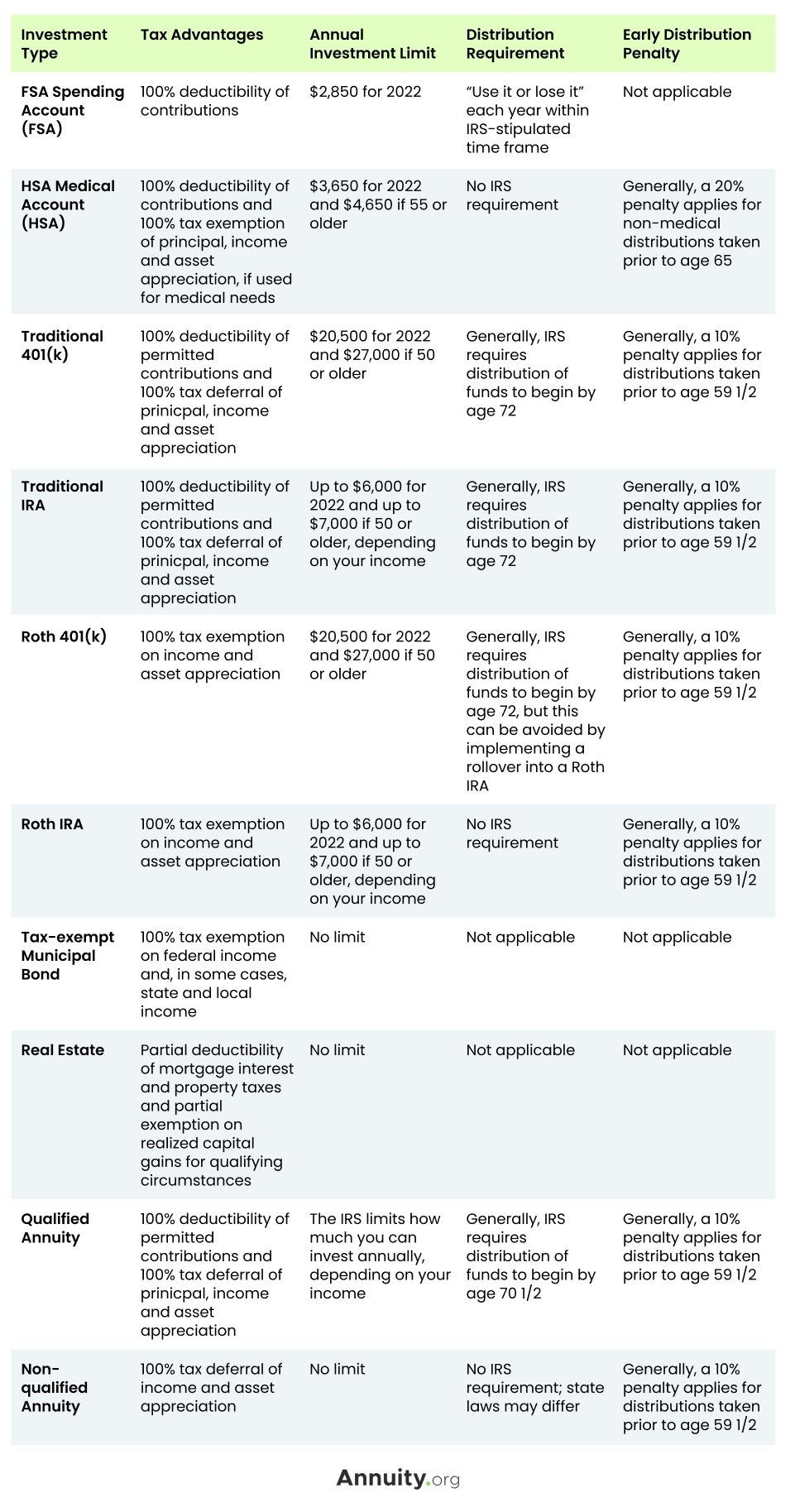

Qualified Vs Non Qualified Annuities Taxation And Distribution

Can Annuities Be Transferred The Answer May Surprise You 2022

How To Avoid Paying Taxes On Annuities Due

Tax Sheltered Annuity Faqs Employee Benefits

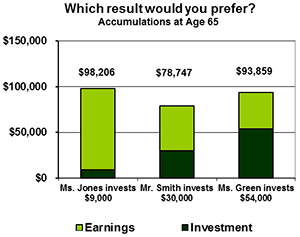

Tax Deferred Annuity Definition Formula Examples With Calculations